Packaging (VAT)

Packaging means breaking down a price into components that carry different value-added tax (VAT) rates. This is useful when creating prices for trips or conferences, where the price consists of for ex. courses, accommodation and transportation.

This article contains...

How to create a ticket with different VAT rates

General overview of VAT rates in Norway

VAT rates in Denmark and Sweden

NOTE: the packaging function is only available in the "Tickets" step in the setup - and should be used when you are presenting the participants with a package of different components. For example conference and accommodation.

However, a lot of Checkin users choose to leave for example accommodation in additional fields. Here, you can also use different VAT rates, but only ONE per additional field.

What is packaging?

Checkin provides organizers the opportunity to build package prices with elements subject to different value-added tax rates. The person purchasing a ticket or registering for an event will be presented with a single price (a package price), but the price includes items that must be accounted for with different types of VAT rates. A good example of this could be a package tour or a conference where the price includes travel or a stay at a conference center, accommodation, and food and/or transportation. As an organizer, you are obliged to account for different VAT rates for each of these components.

Example: A ticket should cost a total of NOK 1200, including VAT. In this example, NOK 800 for the conference ticket should be accounted for at a 25% VAT rate, and the accommodation at NOK 400 should be accounted for at a 12% VAT rate. The customer is externally presented with the total amount of NOK 1200, including VAT.

How to create a ticket with multiple VAT rates

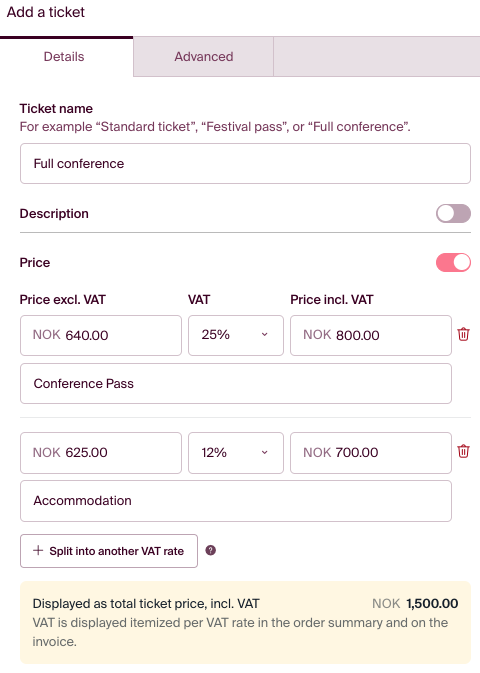

In the "Tickets" step, you add your ticket(s), and select "price". To add a VAT split in the price section, click "+ split into another VAT rate" below the price.

In the yellow field, you can see the price that the buyer will see during registration. The VAT split will not be visible until the order summary and/or the invoice. The VAT split can only be used on the main ticket, not on additional selections in the form builder.

Note! If you have multiple items with the same VAT rate, these must be combined in the same line. It is not possible to have multiple lines with the same VAT rate.

Brief overview of changes to orders and accounting implications

- When editing an order, you cannot change the VAT column for packaged tickets. If the ticket price consists of multiple VAT lines, you can edit the amount on each line but cannot change the listed VAT rate (the percentage).

- If you change the ticket prices in one order, it will not affect the lines in other existing orders.

- Discounts on ticket level are deducted from the ticket price excluding VAT and deduct from the VAT rate listed first, then recalculate the VAT rate on the various lines.

- In the accounting setup, each VAT rate can be linked to a different account, department, and project. For example, you can have an income account for accommodation and one for conference fees.

- The income for a ticket type will be split among the chosen VAT rates (visible in the details of the settlement, see the Excel attachment to the accounting settlement). If desired, it is possible to create a separate link for each VAT rate in "accounting" in the Economy tab, providing detailed information about the VAT split in the accounting entry.

- In the invoice, the price will be shown in specified VAT lines for both the order line and the total VAT for the entire order.

General overview of VAT rates in Norway

General rate, e.g., participation in a conference with turnover* 25%

Food 15%

Restaurant services 25%

Takeaway (excluding alcoholic beverages) 15%

Personal transportation, movie tickets, room rental, accommodation, broadcasting, sports events, amusement parks, and experience centers 12%

*See the article from the tax authorities in Norway here:

Calculation of value-added tax in connection with conferences

(Only available in norwegian)

Other relevant articles:

See an overview of VAT rates for cultural- and sports event.. (EN)

See an overview of the types of conferences that will be subject to tax.. (NO)

Read more about restaurant services VAT. (NO)

Read more about accomadation VAT. (NO)

Read directly in the Value Added Tax Act.. (NO)

VAT rates in Denmark and Sweden

In Denmark, the standard value-added tax (VAT) rate is 25% on most goods and services. There are no reduced rates for food, catering, or accommodation – everything is generally subject to 25% VAT. Some services, such as international passenger transport, certain medical services, and newspapers, may be exempt from VAT.

In Sweden, the standard VAT rate is also 25%, but several reduced rates apply to specific types of services. 12% applies to food, restaurant and catering services, and hotel accommodation. 6% applies to cultural and entertainment events, books, newspapers, and passenger transport. For event organisers, this means that different parts of an event (such as ticket sales, catering, and accommodation) may have different VAT rates, so it’s important to check which rate applies to each component.

VAT exemption

If you sell or distribute tickets for a cultural event, you should not calculate value-added tax on the turnover. If food or catering is sold in connection with the purchase of a ticket, VAT must be deducted from the portion covering the sale of food and drinks. See more about the types of events exempt from VAT in the above articles.

Note! The organizer is responsible for correctly accounting for VAT for their event. Checkin does not take responsibility for checking whether this is accounted for correctly on behalf of the organizer.